Lump sum payment tax calculator

Web Use this calculator to help determine whether you are better off receiving a lump sum payment and investing it yourself or receiving equal payments over time from a third. Web This calculator will help you figure out how much income tax youll pay on a lump sum this tax year.

Pin On Accounting Blog

How is Lump Sum Payment Taxed.

. Web Eligible employees would receive a lump sum payment of up to 70000. Web Use the same PAYG withholding tax tables used at step 1 to work out the amount to withhold for the amount at step 4. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

10 5 for Quebec on amounts up to and including 5000 20 10 for Quebec on amounts over 5000 up. Lump Sum Payments Bonus Etc Average Monthly Profits Income From. Annuity payment calculator compares two payment options.

Discover The Answers You Need Here. The federal tax withholdings are taken out before receiving your lump. Web There are 3 withholding calculators you can use depending on your situation.

Calculate average annual pay for last three years. An individual born after January 2nd 1936. Web How you calculate PAYE depends on your employees tax code.

Your resulting taxable income of 60000 in 1986 would still have you in. Web Lump Sum Extra Payment Calculator. You will also pay state taxes that can.

Web With a 100000 lump sum distribution youd take 10 percent or 10000 and add it to your taxable income. If your state does not have a special. Subtract the amount at step 1 from the amount at step.

Use the following lump - sum withholding rates to. You will also need the amount of past. Multiply this number by 13 to calculate the grossed-up annual value of their.

This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax. Web However there is an online lump-sum payment calculator through which individuals can find answers. Web Use the following lump-sum withholding rates to deduct income tax.

Discover Helpful Information And Resources On Taxes From AARP. Web At least 240000 will automatically be withheld by the federal government and the rest up to 130000 you will owe at tax time the next year. Web Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353 Our lump sum vs.

Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made. Those who left the company by Jan. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Web Add up the employees income payments for the 4 weeks ending on the date of the extra payment. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Web Work out Tax Payable on Pension Provident and Retirement Annuity fund lump sums RETIREMENT FUND LUMP SUMS Use our fund benefit calculator to work out the tax. Student loan repayments and KiwiSaver If your employee uses an M SL or ME SL tax code and earns more than.

Our Resources Can Help You Decide Between Taxable Vs. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Web Use this calculator to help determine whether you are better off receiving a lump sum payment and investing it yourself or receiving equal payments over time from a.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Calculate 115 of the average. Web To use the Lump Sum Calculator you will need your copy or copies of the Income Withholding for Support PDF for the employee.

Web How to Calculate Taxes on a Lump Sum Sapling. 3 received an additional 10000 lump sum. Web A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for.

Web Calculation of tax relief on Eileens retirement lump sum Calculation Value. Web This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Web Lottery Payout Calculator provides Lump-Sum and Annuity Payout for Megamillions Powerball Lotto. Web If an employer pays a lump sum severance package then the withholding tax rate is easy to calculate at the time of payment. Web PAYE calculator on lump sum payment Table 02 - PAYE Tax deduction for Lump-sum-payments.

Web If you get your severance pay as a lump sum your employer will deduct the income tax Beginning Management of Human Resources v 633 17th Street Suite 201 Denver CO. Whether its from a tax refund inheritance bonus or something else making a one-time lump sum extra payment towards your debt can help.

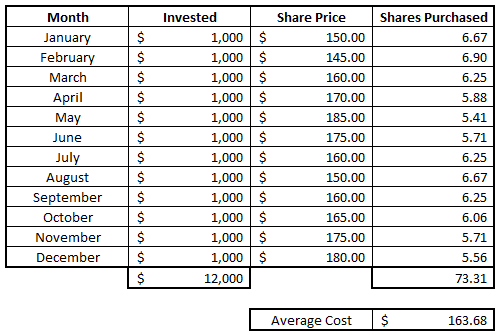

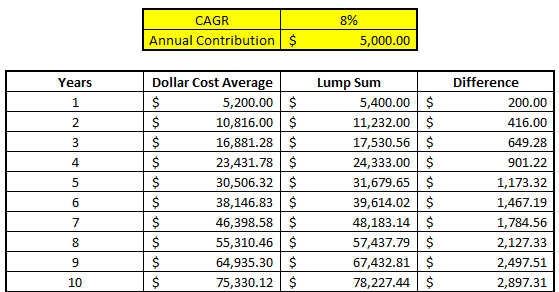

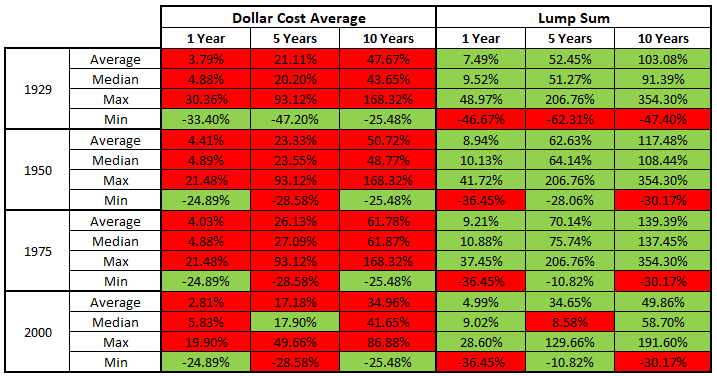

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging

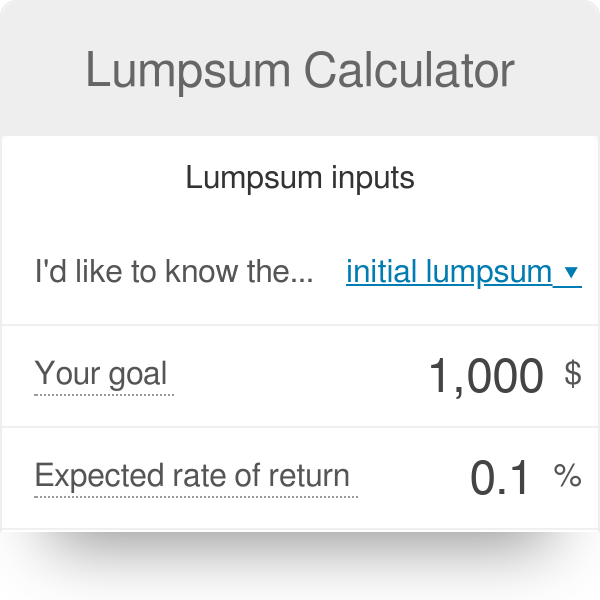

Lump Sum Calculator Airinc Workforce Globalization

How To Calculate Sum Of Squares Sum Of Squares Sum Standard Deviation

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Pension Calculator Pensions Calculator Words Data Charts

Lump Sum Calculator Airinc Workforce Globalization

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Robertstaxservice Redwoodcity Tax Law Loans Financecalculator Tips Tax Services Personal Finance Finance

Lumpsum Calculator

Structured Settlement Lump Sum Calculator Lump Sum Settlement Payout

How And When Should You Pay Your Advance Taxes Income Tax Return Tax Income Tax

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Mutuals Funds Capital Gain Capital Gains Tax

Lottery Tax Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging